Vol. 39 (Number 26) Year 2018 • Page 17

SELIUTINA, Larisa Grigorievna 1; BULGAKOVA, Kseniia Olegovna 2

Received: 12/02/2018 • Approved: 15/03/2018

3. Data description and methods

ABSTRACT: The problem of public housing for low income citizens is very urgent in entire world. This article is dedicated to the topical question of optimal investment projects selection for the implementation within the framework of investment programs in the sphere of public housing construction. We have formulated basic principles of formation of the optimal portfolio of projects for the investment programs for public housing construction. As selection criteria, instead of profitability and risk offered in classical portfolio theory we propose the use of social satisfaction surveys results and amount of funding to determine effectiveness of the programs.We have developed mathematical models for selection of investment projects. The two classes of models for random and determined characteristics of investment-building projects can be used by the public housing programs. These models are solved through linear programming and generic optimization. Application of them to investment projects selection within the framework of investment programs of public housing construction will allow the most effective use of funds directed to the development of the public housing in the region. Models will help to make an objective choice between the projects that will contribute to the solution of housing problem, and consequently to the region development. |

RESUMEN: El problema de la vivienda pública para los ciudadanos de bajos ingresos es muy urgente en todo el mundo. Este artículo está dedicado a la cuestión actual de la selección óptima de proyectos de inversión para la implementación en el marco de programas de inversión en el ámbito de la construcción de viviendas públicas. Hemos formulado los principios básicos de la formación del portafolio óptimo de proyectos para los programas de inversión para la construcción de viviendas públicas. Como criterios de selección, en lugar de rentabilidad y riesgo ofrecidos en la teoría clásica de cartera, proponemos el uso de resultados de encuestas de satisfacción social y la cantidad de fondos para determinar la efectividad de los programas. Hemos desarrollado modelos matemáticos para la selección de proyectos de inversión. Las dos clases de modelos de características aleatorias y determinadas de los proyectos de construcción de inversiones pueden ser utilizadas por los programas de vivienda pública. Estos modelos se resuelven mediante programación lineal y optimización genérica. La aplicación de los mismos a la selección de proyectos de inversión en el marco de los programas de inversión de la construcción de viviendas públicas permitirá el uso más efectivo de los fondos destinados al desarrollo de la vivienda pública en la región. Los modelos ayudarán a hacer una elección objetiva entre los proyectos que contribuirán a la solución del problema de la vivienda y, en consecuencia, al desarrollo de la región. |

Housеbuilding occupies leading position in economic and social researches. Regardless of the form of government, cozy house was always on the top of human needs hierarchy [8]. Historically, the role of the social housing sector was to provide universal access to adequate housing [13].The major part of people nowadays buys and gets housing on market conditions; however, social housing was and is the product of interaction between state and vulnerable citizens [20]. The improvement of interaction structure of all participants of the investment process of social house building took place during the mankind evolutionary development. This sphere differs by the complexity and versatility; therefore it requires development of scientific approaches to its investigation [1]. Without competent control of investments it's impossible to implement the programs of housing sphere modernization, to form favorable investment climate in the region, to carry out structure reforms and responsible housing policy [7]. This principle works also in opposite direction – increase of people’s quality of life is impossible without economic growth, therefore during the development of the programs of social house building one shouldn't forget about its economic efficiency.

One of the most important parts in the social investment programs is to choose the most efficient projects with limited resources. Modern investment theory is based with Harry Markowitz, in his work «Choice of portfolio» there were offered first mathematical models of formation of optimal securities portfolio and shown methods of their construction [15]. We have modified the task of of investment projects selection from the point of view of risk and profitability to the social satisfaction under limited financing need. Additional models for the selection of optimal investment projects of social house building create new investment qualities and perspectives.

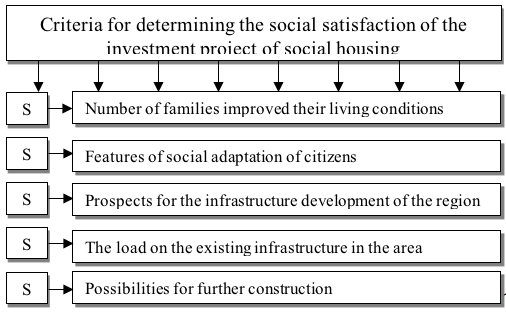

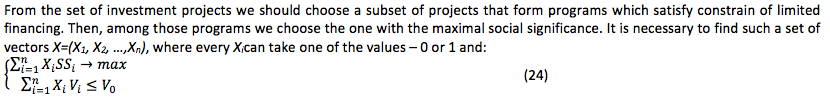

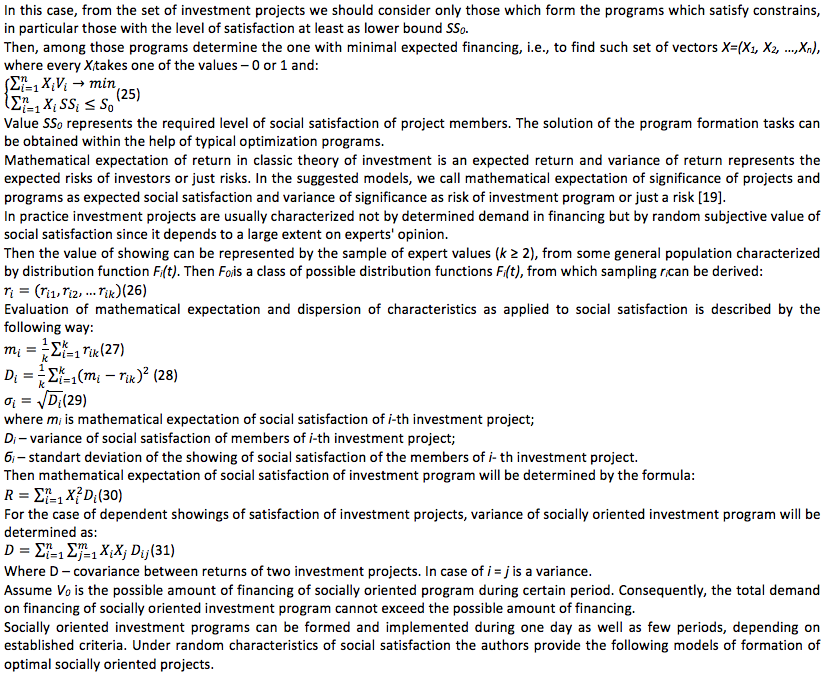

Investment program of social house building can be constructed using different approaches depending on the choice of criteria and constrains. For the selection of optimal projects within the framework of socially-affordable housing building, we suggest the new showing SSi of social satisfaction from i-th investment project Pr. This showing can be interpreted as direct, for example, amount of families having improved housing conditions, as well as indirect, for example, decrease of tension in society, formation of new working places and so on. Social satisfaction will be evaluated subjectively by the each expert based on hypotheses and formulations offered by the authors.

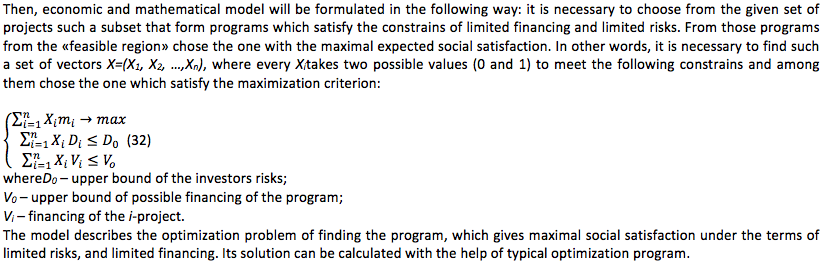

Based on the two key factors we have developed two classes of models for random and determined social significance under limited financing needs of investment projects, which can be solved typical optimization programs and Boolean linear programming method. The suggested models can be effectively applied not only during the formation of social house building programs but also for any socially oriented investment programs.

During the realization of investment programs of social house building, the question of investment projects selection, implemented within the framework of the program, is put in the forefront [10]. What selection criteria should be applied? What project should be given preference? These problems are also not enough studied within the framework of modern investment theory.

Financial theory became a science in 20-30 of XX century: in works of I. Fisher income discounting technique was used for the first time. By the economist's opinion, to correctly assess future income in present, one should use relation of services cost and capital cost.

Evaluation of the main (capital) assets became central topic of works of D.B. Williams, one of the most famous investors of USA. Economist has offered an approach to assets evaluation allowing controlling investment portfolio.

However, all pre-war works were created with a hypothesis about the definiteness of conditions of financial solutions, therefore, in financial analysis, elementary financial mathematics was used. But already in 1921 the work of F.H. Knight «Risk, Uncertainty and Profit» contained the first quality analysis of probability-theoretic mathematical methods of risk events influence [11].

The first investment theories appeared in the developed Western countries; economic agents have already tried to determine formula of optimum complex of investment projects for realization of investment program. This was the time when the term «investment portfolio» appeared.

The concepts of investment program and investment portfolio they are very close: many scientists don't see their principle differences. For example, Vilenskiy P., Smolyak S., Livshits V. in their scientific works draw attention to that investment portfolio is some set of projects which investor considers and then makes decision about implementation of some of them [12; 13].

In addition, the recommended set of projects is called investment program. Some scientists think that these two concepts are equal. Some economists complete the concept of investment program, opening it as an element of the investment strategy of the state. For example, Tyrtyshov J.P. pays attention that the program is a commitment that can make and mobilize resources for its implementation [14].

By our opinion, term «investment program» is wider then notion «investment portfolio» more prevalent today, but they frequently coincide in practice, therefore, within the framework of current research, these two terms will be considered as identical.

Modern investment theory is closely connected with the name of Harry Markowitz: in his work «Choice of portfolio» there was offered first mathematicalmodel of formation of optimal securities portfolio and shown methods of their construction.

Markowitz H. models allowed translating task of investment projects selection from the point of view of risk and profitability to mathematical language. The main results of scientists-economists, received in XX century are focused on the works of Markowitz, the essence of which is that project portfolio is created on the basis of relation risk-profitability or some combinations of risk and profitability [15; 16].

To maximize profit and minimize risks, investors deal not with one asset but allocate capital to different projects. Combination of projects creates new investment qualities and perspectives. Evaluation of separate assets and their portfolios, above all, should take into account 2 showings: relation of expected risk and assets profitability. Modern investment theory takes into account both these characteristics: risk and profitability are assessed quantitatively, that allows investor to form optimal investment portfolio. Theory of «Efficient set of portfolios» remains summit of classic economic theory [17].

Figure 1

Criteria for determing the social satisfaction of the investmentprojects

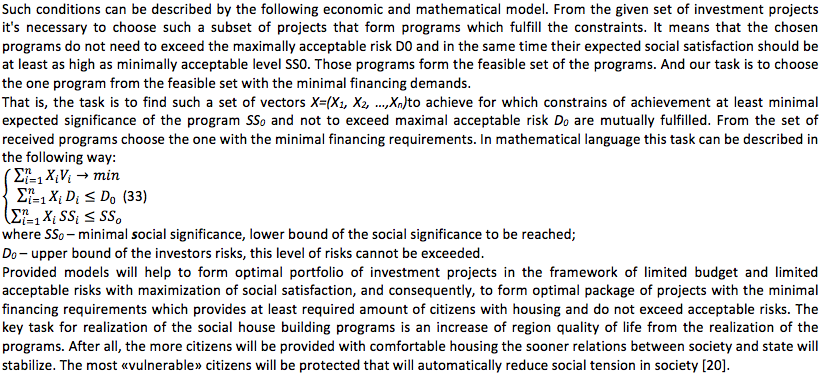

2. Model of program formation based on minimization of financing under the required level of social satisfaction

The housing market becomes increasingly important in the overall structure of the market sector. Social comfortable housing also becomes more important due to both social and economic problems: the state of the housing stock primarily determines the quality of life of the population. Social housing also may be profitable investment from social point of view for private companies. It can enhance the prestige of investor and the loyalty of citizens to his companies; draw up new opportunities and form new social environment. Realization of investment programs of social house building is a complicated, multistage process, one of key stages of which is a selection of the most efficient projects with the framework of the program. This need is especially clearly observed in bid cities where the problem of lack of social housing is really obvious. As a result of all theoretical searches the authors have suggest showings and mathematical models of investment projects selection which will help to expert group in making a decision about the selection of the most profitable objects of social house building from the social point of view. We have developed two classes of models for random and determined characteristics of investment and building projects, which can be solved by Boolean linear programming and typical optimization programs. The suggested models can be effectively applied not only during the formation of social house building programs but also for any socially oriented investment programs.

[1] N.V. Shevchenko, The mechanism of implementation of municipal programs for socio-economic development, Bulletin of the Chelyabinsk State University19 (2008) 59-65.

[2] I.M. Ayzinova, Housing in three dimensions, Forecasting problems, 2 (2007) 90-115.

[3]V.D.Shapiro, V.D., Y.N. Zabrodin, N.G. Olderogge, Management of investment programs and portfolios of projectsMoscow: Delo ANH Publ., 2000

[4] V.A. Zhuk, Regional housing policy in the development strategy of major cities]. St. Petersburg: ROST Publ., 2012

[5] O.O. Zamkov, Mathematicalmethods in Economics. Moscow:DIS Publ., 1997

[6] L.G.Selyutina, K.O. Bulgakova, Development of nonprofit housing as a method of forming an affordable and comfortable accommodation in Saint-Petersburg. Theory and practice ofsocial development, 1 (2014) 374-376.

[7] B. Berens, P.M. Havranek, Guidance on evaluation of investment efficiency. Moscow: Interekspert Publ., 2007

[8] H.M.Heijden, M.E. Haffner, J.S. Hoekstra, Bridging the Gap Between Social and Market Rented Housing in Six European Countries.Delft: Delft University Press Publ., 2006

[9] V.I. Telichenko, E.A. Korol, P.B. Kagan, Fundamentals of management of investment and construction programs in the city. Moscow: Associacii stroitel'nyh vuzov Publ., 2008

[10] V.V. Buzyrev, L.G. Selyutina, V.F. Martynov, Modern methods of management of the housing construction. Moscow: INFRA-M Publ., 2016

[11] F.H. Knight, Risk, Uncertain and Profit. New York:Houghton Mifflin Publ., 1921.

[12] V.N. Livshits, About the methodology for assessing the effectiveness of investment projects. Scientific report. Moscow: Institute of Economic RAN Publ., 2009

[13] Lars A. Engberg, Social housing in Denmark, Roskilde University, Denmark, 2014.

[14]Tyirtyishov, Y.P. Problems of formation of affordable housing market in the Russian Federation. Ekonomika stroitel'stva 11 (2004) 3-38.

[15] H.M. Markowitz, H.M. Portfolio Selection: Efficient Diversification of Investments. New York: Jolin Wiley Publ., 1959.

[16]H.M. Markowitz, H.M. Mean-Variance Analysis in Portfolio Choice and Capital. New York: Jolin Wiley Publ., 1987.

[17] R.C. Merton, Lifetime portfolio selection under uncertainty: the continuous – time case. Review of Economic and Statistics, 51 (1969) 247-257.

[18] F. Modigliani Fluctation in the Saving income ratio: a problem in economic forecasting. Studies in Income and Wealth. New York: NBER Publ., XI, 1949.

[19]W. Sharpe, G. Alexander, J. Bailey, Investments. Moscow: INFRA Publ., 2001.

[20] W. Forster, P. Ahren, I. Behr Guidelines on social housing: Principles and Examples, United Nations, Geneva, Switzerland, 2006.

1. Emperor Alexander I Petersburg State Transport University, St-Petersburg, 192007, Russian Federation Email: ya.slarisa@yandex.ru

2. Saint-Petersburg State University of Economics, St-Petersburg, 192007, Russian Federation. Email: pierott_89@mail.ru