Vol. 39 (Number 33) Year 2018 • Page 6

D.A. SEIDUALIN 1; K.P. MUSSINA 2; K.A. OMAROVA 3; A.Ye. YESSENBAYEVA 4

Received: 07/03/2018 • Approved: 25/04/2018

5. Conclusion/ Summary and concluding remarks

ABSTRACT: The concept of competitiveness is the central category of a market economy which determines the potential ability of various market actors to successfully compete with their competitors. However, the competitiveness of a commodity is characterized not only by its potential, but also by strategic opportunities for implementing, strengthening and expanding its market positions in the future. Nowadays, Kazakhstan demonstrates a large increase in exports of extractive industries. However, the share of processed products with high added value in the country's export structure remains low. It is necessary to increase the presence of science-intensive, innovative products in various industries and agriculture in the context of growing international competition in the export portfolio of Kazakhstan. In the article the authors analyze the current situation on the foreign trade market of the RK for the last 3 years, where the group "Mineral Resources" was considered as the basis of the analysis, the main share of which is up to 70% of the raw materials extracted by the mining industries. The world market, where prices have been falling for the last three years and the export component of the RK has fallen by 60% compared to 2014, forces the Kazakh governance to change the structure of the economy towards diversification and industrialization of mining enterprises. |

RESUMEN: El concepto de competitividad es la principal característica de una economía de mercado que determina la capacidad potencial de diversos actores de dicho mercado para competir con éxito. Sin embargo, la competitividad de un producto básico se caracteriza no solo por su potencial, sino también por las oportunidades estratégicas para implementar, fortalecer y expandir sus posiciones de mercado en el futuro. Hoy en día, Kazajstán demuestra un aumento en las exportaciones de industrias extractivas. Sin embargo, la proporción de productos procesados con alto valor agregado en la estructura de exportación del país sigue siendo baja. Es necesario aumentar la presencia de productos intensivos en ciencia e innovadores en diversas industrias y la agricultura en el contexto de la creciente competencia internacional en la cartera de exportaciones de Kazajstán. En el artículo, los autores analizan la situación actual en el mercado de comercio exterior del RK durante los últimos 3 años, donde el grupo "Recursos minerales" se consideró como la base del análisis, la parte principal de los cuales es hasta el 70% de las materias primas extraídas por las industrias mineras. El mercado mundial, donde los precios han estado cayendo durante los últimos tres años y el componente de exportación del RK se ha reducido en un 60% en comparación con 2014, obliga al gobierno kazajo a cambiar la estructura de la economía hacia la diversificación e industrialización de las empresas mineras. |

For the first quarter of 2017, Kazakhstan's trade increased by 24.2%, in the structure of trade turnover, exports amounted to 30%, and imports 15%.

In monetary terms, exports exceeded $ 10 billion, an increase of $ 2.5 billion: raw material exports rose by $ 1.9 billion, and the remaining 0.6 billion fell on processed goods. If we consider the structure of exports for raw materials, then oil supplies increased by 35 percent. There is an increase in the volume of natural gas supplies by nine percent - up to $ 280 million. Almost three times - up to 182 million dollars - increased exports of copper ore, hard coal - 2.4 times, iron ore - 1.6 times. The reduction in raw material exports was noted only for such items as wheat, barley and raw hides of cattle. Exports of processed goods in the first quarter increased by 21 percent, amounting to 3.4 billion dollars.

In the context of industries, the greatest increase can be noted in the metallurgy and export of mineral products. The increase in the volume of supplies of metals is observed mainly in Asian countries, where about 45 percent of shipments go. The share of processed goods in the export structure of Kazakhstan was 31 percent. In 2013, this indicator was at the level of 23 percent. In total, Kazakhstani goods were sold in 100 countries around 825 positions.

One of the leading classics in the development of competitive strategy is M. Porter who presented a complex system of analytical methods that help the firm to analyze the industry as a whole and make a forecast of its development, understand all competitors of the industry and their position, and also transform this analysis into the competitive strategy of a particular business in his book "Competitive strategy" (Porter, 2014).

In the work of "International Competition", M. Porter was one of the first to systematically consider the country's advantage in the competitive struggle, that is, explaining the properties of the nation, which are the precondition for the success of the national industry in international competition (Porter, 1998).

The reason for the emergence of competition lies in the violation of the market mechanism, i.e. a disproportion between supply and demand. According to A. Smith, who viewed competition as a discrete process, where rivalry arises under the influence of a market imbalance. In other words, the competitive process seemed to him as a transition from one equilibrium to another equilibrium caused by the action of external factors. (Stigler, 1972).

In competition A. Smith saw a mechanism that led the market into a state of equilibrium. In this Smith sees the economic role of competition. He called it the action of the "invisible hand," which sometimes sees something mystical, attributing to it a special meaning (Smith, 1776).

Marxists do not connect the existence of competition with the scarcity of resources, but with the peculiarities of the management conditions. One of the conditions is the transition of society to market exchange. The existence of a market exchange is a material basis that creates the conditions for the emergence of competition. In this case, unlike A. Smith, Marxists attribute the existence of commodity exchange not with the properties of human nature, but with the development of the productive forces of society, which, accompanied by the specialization of producers, generates the need for an exchange of the products of their labor. But competition does not occur in any exchange, but only under conditions of market exchange, when production is carried out solely for the sake of selling in order to gain money income (Marx & Engels, 1967).

The effectiveness of competition Schumpeter interprets from the perspective of the impact of competition on economic development. In his model, the core of competition is not price, but innovation, and the result is not the achievement of market equilibrium, but the generation of progressive changes (lower production costs, broadening the range and improving the quality of products) (Schumpeter, 2008).

The competitiveness of the country is primarily determined by the large base factors of production (natural resources, labor, capital) and the degree of economic maturity (income level per capita, total costs and prices, scientific and technical qualifications, etc.). The availability of resources and qualifications determines the choice of products that a country can technically produce, while relative costs, price and product differentiation determine the economic benefit from producing products in which it has a relative advantage over other countries. Large countries have a huge internal market and therefore, as a rule, despite significant absolute volumes of exports, their share in world trade may not be so significant. This is even more true with respect to the share of exports to GDP (GNP). On the contrary, small and medium-sized countries, for which foreign markets are an indispensable attribute of setting up large-scale production, tend to "lose" in terms of their share in world production and "win" in terms of their share in world trade. Such countries have the highest export share in GDP/GNP (Cleary, 2012).

The source of competitiveness can be internal if it is controlled by a competitor, and external, if the latter is unable to influence the source. In this regard, it is necessary to distinguish two types of competitiveness: created and borrowed.

The created competitiveness is the superiority achieved by the competitor at the expense of the sources controlled by him. Borrowed competitiveness is the superiority that a competitor acquires through the action of sources outside its control and influence.

The competitiveness factor is that driving force, through which the competitor forms or increases sources of competitiveness (Taranukha, 2015).

"Under economic laws, science understands the material, i.e. objective, constant conditions that impel large masses of people to act in the production, distribution and exchange of vital goods in a definite and predominantly identical way "(Malyshev, 1966).

While writing the article, materials of research and design organizations, actual data of mining enterprises of Kazakhstan, as well as periodical reference books of international organizations, such as WTO, the data of the Committee of Statistics of the Ministry of Education and Science of the Republic of Kazakhstan, "KAZNEX INVEST", the official website of the Unified Energy System, the state strategic program of the Republic of Kazakhstan in the field of export strategy were utilized.

To generalize the information received, methods of scientific abstraction, system analysis and synthesis, induction and deduction, comparison and grouping, and the construction of analytical tables and graphs were applied.

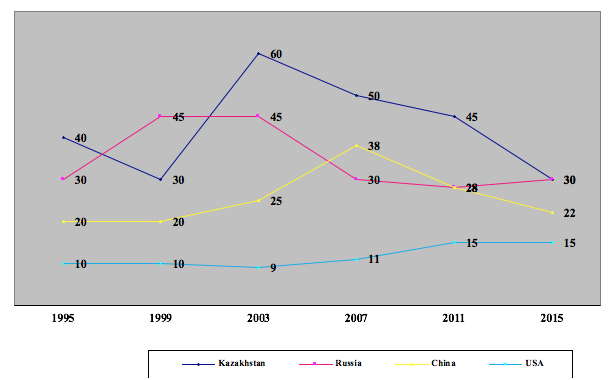

Kazakhstan is one of the most export-oriented countries in the world. According to the World Bank data, the ratio of the volume of exported goods and services to Kazakhstan's GDP in the most prominent years for the economy of the country was at the level of 50-60%. (Figure 1.). This is due both to the small domestic market according to the world standards (in such export giants as China and the USA, this ratio is in the range of 20-35% and 10-15% respectively) and the role in the international distribution of labor. Kazakhstan is a supplier of hydrocarbons and metals to the world market. Similar positions are occupied by two more countries - Russia and Azerbaijan.

Figure 1

Export of goods and services as a ratio to GDP, %

Source: World Bank

The change in prices for resources or the physical volume of products supplied to the world market automatically affects the amount of exports, and, consequently, impacts the inflow of foreign exchange earnings, which provide imports of goods and services.

The decline in the export group of goods with China and Russia led to a decrease in the country's GDP from 4.1 percent in 2014 to 1 percent in 2015, in 2016, witnessing the growth up to 2 percent only in 2017 (Kazakhstan: Adaptation to low oil prices; difficult times ahead. Report on the economy of Kazakhstan, 2015). An increase to 2% of Kazakhstan's GDP was preceded by positive trends in the world market, such as: an increase in oil production, positive dynamics in prices for oil and metals.

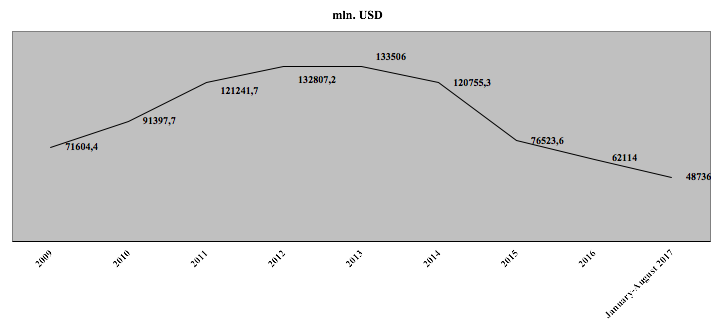

Figure 2

Foreign trade of the RK, million US dollars

Source: Committee on Statistics at the Ministry

of National economy of the Republic of Kazakhstan

If the external trade turnover for 2016 amounted to 62114 million US dollars, then the external commodity turnover for 2017, during January-August months amounted to 48736 million US dollars, the probabilistic forecast may be higher than 2016. The data on which is shown in Figure 3.

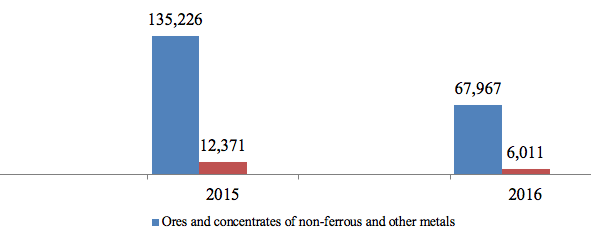

The dynamics of the iron and non-ferrous ores production by the types of metals produced are shown in Table 1.

Figure 3

Dynamics of extraction of ores and concentrates produced in 2017, thousand tons

Source: Committee on Statistics at the Ministry of National economy of the Republic of Kazakhstan

The total volume equaling to 12,371 tons of non-ferrous and other non-ferrous ore and concentrates produced in 2016 were 91% lower than the volume of produced ores in 2015, which happened due to the established prices for metal and the decrease in the quality of minerals.

The volume of metal ores production in Kazakhstan by types produced in Kazakhstan at the beginning of 2017 is represented in Table 1.

Table 1

The volume of production of metal ores by types produced in Kazakhstan in 2017, thousand tons

Production |

2017 |

2016 |

2017/ 2016,% |

Iron ores, non-agglomerated |

3 564 |

38 923 |

9.2% |

Iron ore Concentrates |

781 |

10 101 |

7.7% |

Iron ore, agglomerated |

840 |

10 065 |

8.3% |

Agglomerate of iron ore |

498 |

5 491 |

9.1% |

Iron ore pellets |

328 |

3 387 |

9.7% |

Copper ores |

7 183 |

76 046 |

9.4% |

Copper concentrates |

1 277 |

10 503 |

12.2% |

Copper in copper concentrate |

37 |

440 |

8.4% |

Copper-zinc ore |

417 |

5 703 |

7.3% |

Aluminum ores (bauxites) |

410 |

4 802 |

8.5% |

Gold ore |

1 435 |

18 773 |

7.6% |

Lead concentrates |

26 |

371 |

7.1% |

Lead in lead concentrate |

7 |

71 |

10.5% |

Lead-zinc ores |

498 |

5 779 |

8.6% |

Zinc concentrates |

49 |

647 |

7.6% |

Zinc in zinc concentrate |

25 |

326 |

7.8% |

Manganese ores |

90 |

1 569 |

5.7% |

Manganese concentrates |

30 |

498 |

6.0% |

Chrome ore |

532 |

5 546 |

9.6% |

Chrome concentrates |

357 |

4 153 |

8.6% |

Source

Committee on Statistics at the Ministry of National

economy of the Republic of Kazakhstan

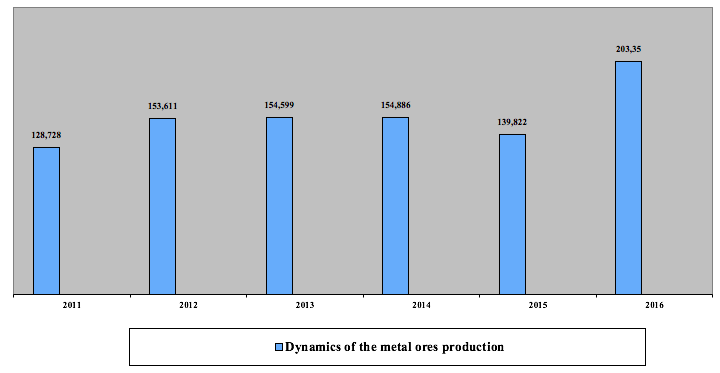

The major part of the ore produced belongs to non-ferrous, of which 7,183 thousand tons are copper ore and 7,000 tons are lead in lead concentrate. Figure 4 demonstrates the dynamics of the metal ores production in Kazakhstan for 2011-2016.

Figure 4

Dynamics of the metal ores production in

Kazakhstan for 2011-2016, thousand tons

Source: Committee on Statistics at the Ministry of National economy of the Republic of Kazakhstan

The analysis reveals a positive trend in the extraction of metal ores, which is confirmed by a 37% increase in metal ores in 2016 compared to 2011. Data on external economic activity of the Republic of Kazakhstan is presented in Table 2.

Table 2

Trade turnover of the RK for the last 3 years.

|

2014 |

2015 |

2016 |

|||

ths.USD |

% |

ths.USD |

% |

ths.USD |

% |

|

Trade turnover |

25080578,7 |

100 |

76278953 |

100 |

60894317,8 |

100 |

Export |

14905224,56 |

59,42 |

80901019,8 |

75,82 |

35903007,3 |

58,96 |

Import |

101753534,14 |

40,58 |

25798355,2 |

24,18 |

24991310,5 |

41,04 |

Source: Committee on Statistics at the Ministry

of National economy of the Republic of Kazakhstan

The data provided in Table 2 demonstrates a significant drop in turnover. In 2016 the turnover decreased by half (by - 58891465.9 thousand US dollars) in comparison with 2014. In the import / export structure, imports increased by 6%, which indicates an increasing demand for the number of imported goods of the group "Machines, equipment, vehicles, appliances and devices" in Kazakhstan, the share of which in imports is 48.5%.

It should be noted that a significant share of up to 70% in the export is occupied by the group "Mineral products", which is confirmed by data in Table 3.

Table 3

The prevailing group of resources in the structure of imports / exports of the Republic of Kazakhstan

2014 |

2015 |

2016 |

January - August 2017 |

||||

The share of "Machinery, equipment, vehicles, instruments and apparatus" import group, % |

The share of "Mineral products" export group, % |

The share of "Machinery, equipment, vehicles, instruments and apparatus" import group, % |

The share of "Mineral products" export group, % |

The share of "Machinery, equipment, vehicles, instruments and apparatus" import group, % |

The share of "Mineral products" export group, % |

The share of "Machinery, equipment, vehicles, instruments and apparatus" import group, % |

The share of "Mineral products" export group, % |

46 |

84 |

30 |

70 |

28 |

60 |

26 |

80 |

Source: Committee on Statistics at the Ministry

of National economy of the Republic of Kazakhstan

Table 3 proves the fact that in the structure of imports, the predominant group of "Machines, equipment, vehicles, appliances and devices" dropped from 45% to 27%, in general, it was possible to stabilize the growth trend of imports, in the structure of exports, the group of "Mineral products" prevails and occupies the share of up to 70%. Kazakhstan has completely reoriented the entire structure of the economy to raw materials, which can have a very adverse economic effect in the long term affecting economy's growth.

Over the last 2015-2016, there has been a significant downward trend in trade turnover compared to 2014. As we know, the prices for the main raw material (oil) in 2014 were the highest and amounted to 114 US dollars per barrel of oil. In recent years, due to the fall in oil prices to $ 50 per barrel of oil, the trade turnover compared to 2014 decreased by 57.5% in 2015, and by 76% in 2016 (The module of the marketing directory KazDATA. The indicators of foreign trade and the structure of Kazakhstan's import and export., 2016).

The efficiency of foreign trade in 2014 was 59%, in 2015 and 2016 it was at the level of 32% and 14% respectively. The balance of foreign trade efficiency is positive, although we can notice a significant drop. The drop in the efficiency of foreign trade is facilitated by the percentage of the decrease in sales of the "Mineral Products" export group.

The main shares of exports and imports in commodity turnover, respectively, in the groups of "Mineral products" and "Machinery, equipment and machinery, electrical equipment" are presented in Table 4.

Table 4

The main share indicators of foreign trade in the last three years

Commodity groups |

2014 |

2015 |

2016 |

Exports: Mineral products |

67,68% |

71% |

64,69% |

Imports: Machinery, equipment |

46% |

30,45% |

28,68% |

Source: Committee on Statistics at the Ministry

of National economy of the Republic of Kazakhstan

Mineral products, as the main revenue part of the export group representing the commodity sector, as a whole demonstrate the dynamics of the decrease, which is primarily due to the lack of a diversified economy in the country. Export earnings significantly affect the country's imports, since the main products for production come from the purchase of goods from abroad. The development of exports leads to the development of the country's production potential (Ministry of Investment and Development of the Republic of Kazakhstan, 2014).

In general, 80% of the export group belongs to the extractive industry. The 10 main positions of this group are presented in Table 5.

Table 5

The most exported positions of 25-27 Harmonized commodity

description and coding system's "Mineral products" group

Total by commodity group |

||

1 |

2709 |

Crude oil |

2 |

2711 |

petroleum gases |

3 |

2710 |

oil products |

4 |

2601 |

ores and concentrates, iron |

5 |

2603 |

copper ores and concentrates |

6 |

2701 |

Coal |

7 |

2503 |

Sulfur |

8 |

2610 |

ores and concentrates chrome |

9 |

2608 |

zinc ores and concentrates |

10 |

2716 |

electric power |

other positions |

||

Source: Committee on Statistics at the Ministry of

National economy of the Republic of Kazakhstan

A significant decrease in foreign and domestic trade qualitatively affects the economic growth of the economy of Kazakhstan. Decrease in demand for mineral resources and long-term policies aimed at the development of the commodity sector had a painful effect on the results of the revenues receipt to the budget of Kazakhstan from export products, a significant portion of which are products of extractive industries.

A special role in the economic development of the country will be played by export-oriented and import substitution of the products created within the country. Low export revenues from extractive industries contribute to the growth of imported products in the country (Glushak N.V.& Glushak O.V., 2015).

The loss of major importers, namely of Italy, France, and China, which significantly reduced the import of raw materials to their countries, require Kazakhstan to take immediate measures to introduce new technologies to produce high-value-added products. In support of the mining companies, Kazakhstan adopted and implements the National Export Strategy until 2022.

Kazakhstan possessing large reserves of mineral and energy resources must intensively engage in export-oriented raw materials to the world market, but at the same time should not abandon the strategy of import substitution by modernizing the mining enterprises of Kazakhstan and limit the import of oil products and metal products from other countries.

Porter, M. E. (2014). Competitive strategy: Techniques for analyzing industries and competitors. New York: Free Press.

Porter, M. E. (1998). The competitive advantage of nations: With a new introduction. Hampshire: Palgrave.

Stigler, G. J. (1972). Perfect Competition, Historically Contemplated. Readings in Industrial Economics, 105-130. doi:10.1007/978-1-349-15484-5_7

Smith, A. (1776). An inquiry into the nature and causes of the wealth of nations. Raleigh, N.C.: Alex Catalogue.

Marx, K., & Engels, F. (1967). Capital. N.Y: Internat. Pubs.

Schumpeter, J. A. (2008). Capitalism, socialism, and democracy. New York: Harper Perennial Modern Thought.

Cleary, M. (2012). International Trade. Delhi: Learning Press.

Taranukha, I. U. (2015). Competition and competitiveness. Moscow: Rusynes

Malyshev, I. S. (1966). Economic laws of socialism and planning. Moscow.

Kazakhstan: Adaptation to low oil prices; difficult times ahead. Report on the economy of Kazakhstan. (2015). p.28.

The module of the marketing directory KazDATA. The indicators of foreign trade and the structure of Kazakhstan's import and export. (2016).

Ministry of Investment and Development of the Republic of Kazakhstan (2014). Analysis of trends in world trade and foreign trade of Kazakhstan. JSC "National Agency for Export and Investment" KAZNEX INVEST"

Glushak , N. V., & Glushak, O. V. (2015). Place and role of the raw material complex in the formation of the export potential of Russia. Bulletin of the Bryansk State University, (3), 261-264.

1. L.N. Gumilyov Eurasian National University, Astana, Kazakhstan, PhD, Associate professor.

2. L.N. Gumilyov Eurasian National University, Astana, Kazakhstan, PhD, Associate professor. Email: kamshatmussina@mail.ru

3. L.N. Gumilyov Eurasian National University, Astana, Kazakhstan, Master of Economics, Senior lecturer.

4. L.N. Gumilyov Eurasian National University, Astana, Kazakhstan, Master of Economic Sciences, Senior lecturer