Vol. 41 (Issue 08) Year 2020. Page 7

NOVIKOV Sergey V. 1; LASTOCHKINA Vera V. 2 & SHUNINA Elizaveta Ya. 3

Received: 23/07/2019 • Approved: 27/02/2020 • Published 12/03/2020

ABSTRACT: The article deals with the definition of "business activity", the concept of it, approaches to determining the essence, the criteria for the evaluation, functions, factors affecting the business activity of the organization. The article presents indicators of evaluation of business activity of the organization. The relevance of this topic in the modern economy is revealed. There is the influence of the wide spread of the digital economy on the indicators of business activity. |

RESUMEN: El artículo aborda el concepto de actividad empresarial, los enfoques para determinar la esencia de la misma, los criterios para su evaluación, sus funciones y los factores que afectan a ella. Asimismo, el documento presenta indicadores de evaluación de la actividad empresarial y muestra la relevancia de este tema en la economía moderna. A su vez, el artículo aborda la influencia de la amplia difusión de la economía digital sobre los indicadores de la actividad empresarial. |

The key to the survival of economic entities in the modern economy has become their competitiveness and business activity.

Business activity of the organization is the effectiveness of the organization with respect to the amount of advanced resources or the value of their consumption in the production process.

Currently, business activity is one of the important factors that determine not only the financial stability of enterprises, but also their ability to innovative development in the current period and in the future.

The relevance of business activity is due to the fact that in today's market a large level of competition and companies try to get the most profit from activities with minimal costs. We cannot achieve the effective and dynamic development of the organization and increase of its competitiveness without business activity management.

Business activity is revealed in all spheres of human economic activity. At the State level, it is as an indicator of economic expectations of representatives of business society. Business activity allows enterprises to realize the potential of growth and achieve market leadership, implement strategic development plans. Business activity allows enterprises to implement strategic development plans, realize the growth potential, and achieve market leadership, economically competently managing all resources.

The concept of business (economic) activity of the organization includes:

The analysis of business activity of the organization allows to estimate objectively activity of the organization at the moment and to make the forecast about its functioning in the future.

Table 1 presents the content of the main approaches to the definition of business activity.

Table 1

Basic approaches to the definition

of the business activity

Traditional (resource) |

Structural |

Perspective (complex) |

It is considered as a characteristic of the intensity and efficiency of the use of resources available to the enterprise |

It is an integral characteristic of the company's activity in various types: investment, marketing, production, etc. |

It characterizes the economic and production potential of the enterprise, and its development is represented by positive dynamics of performance indicators |

The analysis of the actual approaches about the disclosure of the concept of business activity allowed giving its interpretation in a broad and narrow sense.

Effective use of the organization's resources significantly affects its business activity. In a broad sense, business activity is represented as a range of actions that are aimed at promoting the organization in the market of products, in financial activities, the labor market, etc.

In the analysis of financial and economic activity, this term is also considered in a narrower sense. To assess business activity, we use the following indicators: turnover ratios, asset turnover periods, indicators for assessing the results of financial and economic activities, including profitability.

In the economic literature there are different definitions of the concept of "business activity". L. V. Dontsova and N. Ah. Nikiforov believes that "business activity in the financial aspect is manifested primarily in the speed of turnover " (Dontsova & Nikiforova, 2003). V. V. Bocharov believes that "business activity of the enterprise is measured using a system of quantitative and qualitative indicators " (Bocharov, 2005).

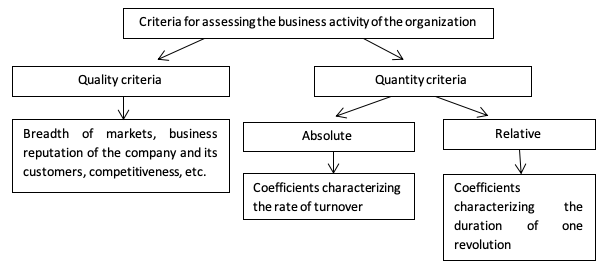

Quantitative and qualitative criteria for assessing the business activity of the organization are shown in the figure 1.

Figure 1

Criteria for assessing the business

activity of the organization

(Source: authors)

Business activity reflects the efficiency of the company with respect to the amount of consumption of resources in the production process or the amount of advanced resources, and also gives a description of financial and economic activity, reveals the potential and internal capabilities of the organization.

It should be noted that business activity reveals the potential of the enterprise, its internal capabilities.

In general, business activity can be considered:

In the first case, business activity characterizes the whole complex of management technologies that are aimed at promoting the organization in the commodity and financial markets.

In the second, the term is considered more narrowly: as the current production and commercial activities of the organization, based on the growth of efficiency and competitiveness.

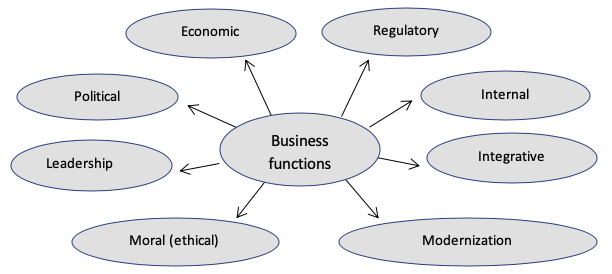

The main functions of business activity are shown in figure 2.

Figure 2

Business functions

of the organization

(Source: authors)

The main functions of business activity include:

Business activity is also interrelated with other important characteristics of the organization. It is undeniable that business activity affects the investment attractiveness and financial condition of the organization. High business activity of the organization motivates potential investors to invest in its assets (Polkovski, 2008).

Business activity is a comprehensive and dynamic characteristic of commercial activity and efficient use of resources of an economic entity.

In the macroeconomic aspect, the concept of "business activity" is widely used to characterize the state of the economy as a whole and its individual sectors.

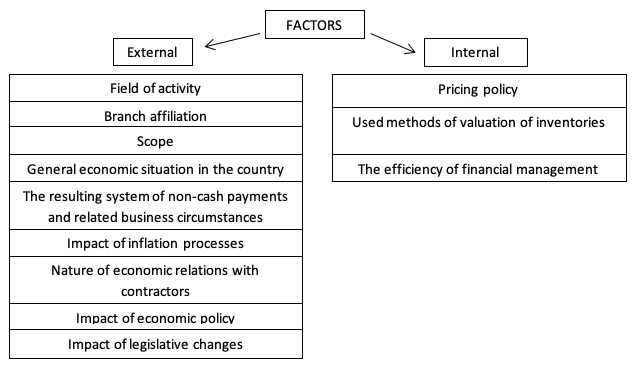

Business activity is influenced by a number of external and internal factors, which are shown in the figure 3.

Figure 3

External and internal factors affecting

the business activity of the organization

(Source: authors)

field of activity (intermediary, supply and marketing, production, etc.);

branch affiliation (turnover of working capital at the weaving factory and aircraft factory will be different);

scope (most often the turnover of funds in small organizations is much higher than in large ones, this is one of the leading advantages of small business);

general economic situation in the country;

the resulting system of non-cash payments and related business circumstances;

impact of inflationary processes (inflation processes, lack of well-regulated economic relations with buyers and suppliers lead to the forced accumulation of reserves, seriously slowing down the process of turnover of funds);

nature of economic relations with contractors;

impact of economic policy;

impact of legislation changes, etc.

pricing policy (management activities to establish, maintain and to change the prices of goods, aimed at achieving the goals and objectives of the organization);

used methods of valuation of inventory and inventories (method of piece valuation, the first in stock – the first in production, the last in stock – the first in production, method of average cost, method of moving average);

efficiency of financial management (as far as the chosen set of techniques, methods used in the enterprise to increase profitability and minimize the risk of insolvency is successful for the organization), etc.

The solvency of the organization is directly linked to the speed of asset turnover, which makes it mandatory to conduct a full analysis of their turnover.

The significance of the turnover analysis is that it makes it possible to understand the general position of the financial condition of the organization in the dynamics.

Business activity is motivated by macro-and micro-level process of management of financial and economic activities of the organization, aimed at achieving its positive dynamics, increasing employment and efficient use of resources to improve market competitiveness and a stable position in the competitive market. The material well-being of any organization depends on how soon the invested money will bring a net profit (Komarova, Zamkovoi, & Novikov, 2018).

Analysis of the coefficients of business activity makes it possible to understand if the firm uses its resources effectively. The analysis of business activity consists in studying the levels and dynamics of economic turnover coefficients (Stone & Hitching, 2015).

The economic condition of the enterprise, its solvency and liquidity depend on how quickly the funds invested in the assets turn into real money. This kind of influence is characterized by the fact that the speed of turnover of funds is associated with:

demand for additional sources of financing (and fees for them);

minimum required amount of advanced cash and related payments (interest for the use of bank loans, dividends on shares, etc.);

amount of taxes paid;

amount of costs for inventory items and their storage, etc.

Cash inflows often do not coincide with current expenditures, resulting in the need for more or less funding for the organization in order to maintain solvency. The faster the turnover of working capital, the less need for additional funding.

The factors that influence the formation of the financial policy of the organization are divided into external and internal.

External financing is expensive and has a number of drawbacks. Own (internal) sources of raising funds are limited, first of all, the possibility of obtaining the required profit. With proper management of current assets, the organization will be less dependent on external sources of funds and increase its liquidity. Rational management of current assets is considered one of the ways to meet the need for cash (Pinkovtskaia, Balynin, Arbeláez Campillo & Rojas-Bahamón, 2019).

One of the important areas of assessment of the financial condition of the organization is the analysis of the system of indicators of business activity to determine how dynamic and sustainable is the development of the organization and whether it uses its resources effectively.

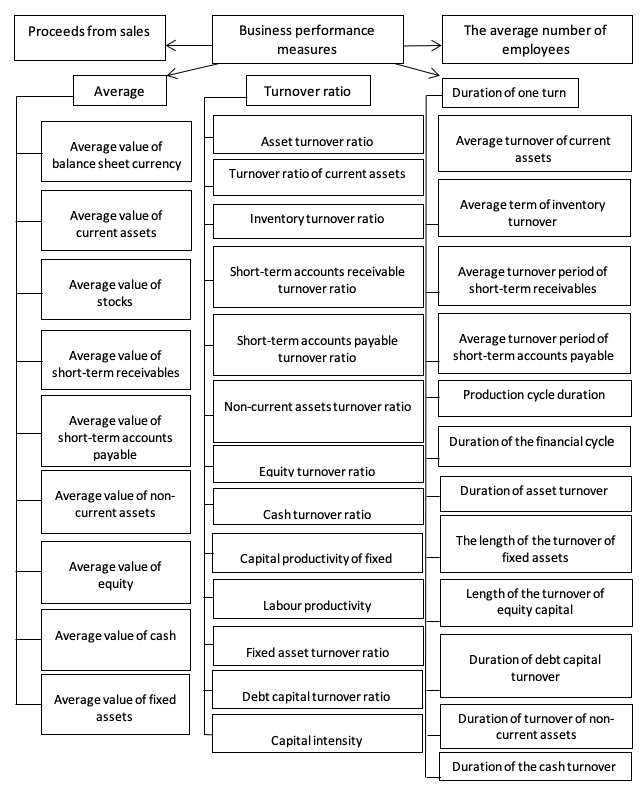

Turnover indicators reflect the efficiency of the use of material, labor, financial resources, as well as fixed assets. When conducting an analysis of business activity, analytic organizations study various levels and dynamics of ratios and periods of turnover of certain types of assets and liabilities. Business performance indicators are shown in the figure 4.

Figure 4

Business performance measures

(Source: authors)

In the analysis it should be considered that even in stable functioning organizations, the values of business activity indicators may not be high enough, if they make large investments in the development of new products, reconstruction of production, modernization and development of equipment, reorganize the organizational structure of management, etc. (Novikov, 2019).

Analysis of business activity allows us to assess the economic condition of the enterprise and its potential and to identify existing problems in the course of making and implementing management decisions for the subsequent implementation of the necessary measures to improve performance.

The main role in the information support of the analysis of business activity of the organization is the financial statements, which reflects the property and financial position of the organization and the results of its economic activities.

The average values are counted to calculate all the necessary turnover factors.

Turnover ratios reflect how effectively the assets (capital) of the organization are used by measuring the speed of their turnover and express the number of revolutions (in times) that the assets (capital) of the organization or their elements make for the analyzed period.

Turnover ratios are easily transformed into indicators of the period of turnover of assets (capital): for this, the number of days per year (365) is divided by the value of the corresponding coefficient. The obtained indicators characterize the average period (duration) for which the relevant assets (capital) are returned to the economic activity of the organization (the number of days required for their turnover).

The indicators of business activity reflect the efficiency of the organization's own funds. One of the main indicators is the turnover ratio of current assets, which can be used to determine the profitability of the organization. If this ratio is greater than one, the organization is profitable.

In the evaluation and analysis of indicators there is a conclusion of positive business activity of the organization, and we identify indicators that have a negative trend. Based on obtained results, measures are being developed to improve the performance of the organization’s business activity, which will increase its competitive ability in the market and provide it with a competitive advantage (Dmitriev & Novikov, 2017).

Increasing the level of competitiveness of the organization will attract new consumers, which will lead to the expansion of the market and increase the revenue of the organization. In this regard, the credibility of the organization will increase and new potential partners, potential investors may be attracted to cooperation; there will be additional financial support for the organization.

In the modern economy, this topic is relevant, because the positive dynamics of business activity of the organization reflects how it is beneficial for cooperation. Nowadays, the widespread digital economy has an impact on the economy.

"The digital economy is an economic activity in which the key factor of production is data in digital form, processing of large volumes and the use of the analysis results of which in comparison with traditional forms of management can significantly improve the efficiency of various types of production, technologies, equipment, storage, sale, delivery of goods and services" (Basovskiy & Luneva, 2014).

The purpose of the national program for the development of the digital economy is to create favorable organizational and regulatory conditions in Russia for the effective development of the institutions of the digital economy with the participation of the state, the national business community and civil society and to ensure rapid growth of the national economy through qualitative changes in the structure and management of national economic assets, achieving the effect of the "Russian economic miracle" in the formation of the global digital ecosystem (Novikov & Veas Iniesta, 2018).

The main tasks of the digital economy include:

ensuring technological leadership of the country in terms of financing the global digital space;

increased productivity;

creating user-friendly interfaces for communication of citizens with government;

formation of a qualitatively new structure of economic assets that meet the economic priorities of the digital economy;

creation of principles of effective management of formed economic assets (resources) and improvement of management of existing economic assets (resources), etc.

The advantages of the digital economy include:

labor productivity growth;

improving the competitiveness of companies;

cost reduction;

creation of new jobs;

access to closed markets;

overcoming poverty and social inequality.

It is recognized that the growth of the digital economy has a significant impact on the economy as a whole and on business activity in particular.

At the stage of formation of new technologies that improve various areas of activity of organizations, increases the efficiency of various aspects of production. In this regard, there is an increase in business activity, the organization acquires investment attractiveness and becomes more profitable and competitive in the market.

To determine profitability and competitiveness of the organization, a number of indicators for assessing the business activity of the enterprise are calculated. It also analyzes external and internal factors that may affect them.

In the modern economy, the assessment and analysis of business activity indicators of an organization is one of the main tasks of enterprises in order to achieve a competitive advantage in the market.

Basovskiy, L.Е., Luneva, A.M. (2014). Economic analysis (Complex economic analysis of economic activity): textbook. Moscow: INFRA.

Bocharov, V.V. (2005). Financial analysis: Short course. S.-Petersburg: Piter.

Dmitriev, O.N., Novikov, S.V. (2017). Conception of managing of fuzzy-institutional meso-level organizational separations in a context of product projects internationalization. European Research Studies Journal, 20(4), 277-289.

Dontsova, L.V., Nikiforova, N.A. (2003). Analysis of financial statements: textbook. Moscow: Delo I servis.

Komarova, N.V., Zamkovoi, A.A., Novikov, S.V. (2018). The Fourth Industrial Revolution

and Staff Development Strategy in Manufacturing. Russian Engineering Research, 39(4), 330–333.

Novikov, S.V. (2018). The features of innovative processes in the Russian Federation: Analysis of current practices. Revista Espacios, 39(39), 2-11. Retrieved from: http://www.revistaespacios.com/a18v39n39/18393902.html

Novikov, S.V., Veas Iniesta, D.S. (2018). State regulation of the development of the connectivity of the Russian territory. Revista Espacios, 39(45), 20-27. Retrieved from: http://www.revistaespacios.com/a18v39n45/18394520.html

Pinkovtskaia, I.S., Balynin, I., Arbeláez Campillo, D.F., Rojas-Bahamón, M.J. (2019). Small business development in Russia: results of the assessment of sectoral structure and number of employees. Revista Espacios, 40(7), 6-17. Retrieved from: http://www.revistaespacios.com/a19v40n07/19400706.html

Polkovski, L.M. (2008). Analysis of accounting (financial) statements: educational and methodical complex. Moscow: Finance and statistics.

Stone, D., Hitching, K. (2015). Accounting and financial analysis: preparatory course. Moscow: Accounting and Analysis.

1. PhD in Economics, Associate Professor, Institute of Engineering Economics and Humanities, Moscow Aviation Institute (National Research University), 125993 Volokolamskoe highway 4, Moscow, Russia, ncsrm@mail.ru

2. Associate Professor, Moscow Aviation Institute (National Research University), 125993 Volokolamskoe highway 4, Moscow, Russia, engecin_mai@mail.ru

3. Student, Moscow Aviation Institute (National Research University), 125993 Volokolamskoe highway 4, Moscow, Russia, engecin_mai@mail.ru

[Index]

revistaespacios.com

This work is under a Creative Commons Attribution-

NonCommercial 4.0 International License